Partnership for Investment

Partnership for Investment

Adopting an environmental, social and governance (ESG) policy and committing to the PRIs has necessitated an in-depth look at our business activities. As global citizens, we realize that we have an obligation to address global sustainability issues and align our activities with the SDGs.

We asked ourselves, where can we have most impact?

Where can we make a difference?

We examined our activities through a sustainability lens and realized that for each of our

business lines there are specific areas where our expertise and strategic positioning allow us

to be of maximum effectiveness in realizing the SDGs. This goes beyond simply aligning our

investments with our ESG policy; rather, it is a proactive approach that looks at specific SDG

targets and how we can help fulfil them.

Building Bridges

As part of the number one investment banking platform in the MENA region, the EFG Hermes Investment Banking Division has leveraged its unique deal-sourcing efforts and ability to raise considerable demand from global investors to consistently execute landmark transactions across an expanding geographical footprint. Despite market adversities, the division’s flexibility and unique capacity to adapt its business model to shifting market dynamics has seen it remain a market leader with a consistent ability to deliver outstanding value.

The signature conference series held annually in the UK, the UAE

and Egypt forms a key element in the Investment Banking

division’s ability to source unique deals and bring together diverse

public and private entities across both developed markets and

FEM. While not explicitly advocating sustainability issues, the

rationale behind these conferences nevertheless very closely

mirrors SDG targets 17.16 and 17.17 which encourage multistakeholder

partnerships that mobilize and share knowledge,

expertise, technology and financial resources to support the

achievement of the sustainable development goals in all countries,

and in particular, in developing countries. The conferences also advocate for target 10b, which

encourages foreign direct investment in markets where the need is greatest.

The signature conference series held annually in the UK, the UAE

and Egypt forms a key element in the Investment Banking

division’s ability to source unique deals and bring together diverse

public and private entities across both developed markets and

FEM. While not explicitly advocating sustainability issues, the

rationale behind these conferences nevertheless very closely

mirrors SDG targets 17.16 and 17.17 which encourage multistakeholder

partnerships that mobilize and share knowledge,

expertise, technology and financial resources to support the

achievement of the sustainable development goals in all countries,

and in particular, in developing countries. The conferences also advocate for target 10b, which

encourages foreign direct investment in markets where the need is greatest.

Our push into FEM in the last few years, together with our presence in Europe, the US and the

Gulf, have positioned us ideally to promote strategic partnership and investment, building both

on our experience and our commitment to sustainability. We bring together fund managers,

institutional investors, government representatives and companies in a setting that allows

for all partners to understand the other’s needs and capabilities and work together towards

fulfilling development goals.

2018 marked another successful year for EFG Hermes’ signature conferences, with both the One on One in Dubai and the London Conferences boasting larger turnouts in terms of presenting companies and global investors. EFG Hermes also hosted a conference in its home market of Egypt. At the Egypt Day Conference held in January 2018, global and regional institutional investors representing more than USD 3.5 trillion in assets under management met with members of the Egyptian government including H.E. President Abdel Fattah El Sisi, the Governor of the Central Bank of Egypt (CBE), and members of the Egyptian Council of Ministers’ economic group as well as top executives from the country’s leading companies in the banking, real estate, construction, manufacturing and food industries.

One on One Dubai

- 173 companies

- 26 countries

- 500 investors

- 255 institutional investors with more than USD 8 trillion assets under management (AUM)

London Conference 2018

- 151 companies

- 10 Industries

- 27 countries

- 327 fund managers and institutional investors from Europe, USA, Asia and MENA

The Egypt Day Conference

- H.E. President Abdel Fattah El Sisi

- Governor of the CBE

- Members of the Cabinets economic group

- 27 investors from 22 companies

- C-suite executives from Egypt’s top companies

EFG Hermes takes pride in its role to bridge the gap between global capital and opportunities in high-growth markets. The conference offers a rare forum for active fund managers to gain on-the-ground insights and intelligence about how increased transparency, tougher regulations and new technologies are reshaping FEM investment in 2018.

Karim Awad

EFG Hermes Group CEO

Raising the Bar

At first glance, the role of the private sector in delivering SDG 16 might not seem obvious. In practice, however, financial services firms can create profound contributions to SDG 16 through their commitment to and promotion of good governance. According to the United Nations Development Programme (UNDP), corruption, theft and tax evasion cost developing countries over a trillion US dollars annually. Corruption can take many forms such as bribery, fraud, insider trading or even value manipulation in transactions and loan collateral.

At EFG Hermes, we believe that it is

imperative that we promote good

governance throughout our areas of

influence. This extends to our awardwinning

research department, with

coverage spanning 24 countries

across the Middle East, Africa,

Europe, the Indian sub-continent

and Southeast Asia. We offer

unrivalled, direct access to FEM, as well as in-depth coverage of more

than 263 equities, with the number of stocks we cover set to expand

significantly in the near future.

At EFG Hermes, we believe that it is

imperative that we promote good

governance throughout our areas of

influence. This extends to our awardwinning

research department, with

coverage spanning 24 countries

across the Middle East, Africa,

Europe, the Indian sub-continent

and Southeast Asia. We offer

unrivalled, direct access to FEM, as well as in-depth coverage of more

than 263 equities, with the number of stocks we cover set to expand

significantly in the near future.

With the increased presence in FEM, EFG Hermes Research has started to place greater focus on corporate governance in its research reports, particularly in markets where anti-corruption measures can be somewhat opaque. Our aim is to provide our clients with the information they need to make informed decisions. We believe that transparent policies and stringent anti-corruption measures have significant positive effects on the risk profile of equities. In this way, we hope to decrease corruption and bribery as well as encourage increased adoption of non-discriminatory policies and illegal labour practices.

The award-winning team is made up of a diverse

range of highly-qualified analysts with the requisite

experience to deal with volatile stocks in FEMs. Our

analysts are the reason we are consistently ranked at

the top of equity research polls for our coverage (#1

in Extel’s Frontier Market ranking, #2 in Extel’s MENA

ranking and #1 in Institutional Investor’s rankings). The

EFG Hermes Research team has analysts on the ground

in Cairo, Dubai, Muscat, Riyadh, Karachi, Dhaka,

Nairobi, Singapore and London allowing us to give

clients indispensable research on equities and macroeconomics from a local perspective.

The award-winning team is made up of a diverse

range of highly-qualified analysts with the requisite

experience to deal with volatile stocks in FEMs. Our

analysts are the reason we are consistently ranked at

the top of equity research polls for our coverage (#1

in Extel’s Frontier Market ranking, #2 in Extel’s MENA

ranking and #1 in Institutional Investor’s rankings). The

EFG Hermes Research team has analysts on the ground

in Cairo, Dubai, Muscat, Riyadh, Karachi, Dhaka,

Nairobi, Singapore and London allowing us to give

clients indispensable research on equities and macroeconomics from a local perspective.

Financing the Future

Investors, both individual and institutional, are exploring how to increase their contribution to the SDGs while continuing to seek opportunities for competitive financial returns. At EFG Hermes, our business lines have assembled a portfolio that includes initiatives that directly feed into the SDGs in areas ranging from education and clean energy to microfinance and technology.

Finance: Microfinance Solutions

SDG 1 aims to ‘end poverty in all its forms everywhere’ while SDG 8 promotes

‘sustained, inclusive and sustainable economic growth, full and productive

employment and decent work for all’. One of the key foundations both for

ending poverty and for creating jobs is to ensure equal rights to economic

resources, whether through access to credit, training or capacity building.

Over the past few years, EFG Hermes has been resolutely diversifying its

product offerings in cooperation with a range of partners, particularly in

microfinance.

SDG 1 aims to ‘end poverty in all its forms everywhere’ while SDG 8 promotes

‘sustained, inclusive and sustainable economic growth, full and productive

employment and decent work for all’. One of the key foundations both for

ending poverty and for creating jobs is to ensure equal rights to economic

resources, whether through access to credit, training or capacity building.

Over the past few years, EFG Hermes has been resolutely diversifying its

product offerings in cooperation with a range of partners, particularly in

microfinance.

These efforts are in line with government and Central Bank of Egypt (CBE) efforts to boost the SME sector—widely regarded as the backbone of the country’s economy and estimated to generate significant percentage of the nation’s GDP. Our aim is to reach a wider client base through a variety of channels, providing accessible and affordable financing, encouraging entrepreneurship and contributing both towards realizing the SDGs and to more inclusive economic growth and better living standards in Egypt.

Tanmeyah

Tanmeyah Microenterprise Services is Egypt’s leading private-sector provider of microfinance solutions and a key element of the Firm’s non-bank financing platform that also includes EFG Hermes Leasing. At the heart of Egypt’s economy, the microenterprise sector plays a pivotal role in poverty reduction. Consistent with the Firm’s commitment to serving underprivileged communities, Tanmeyah offers comprehensive microfinance solutions to owners of very small businesses across Egypt who would otherwise have no access to growth capital or banking sector services.

1 million

loans

served and

counting

In 2018, Tanmeyah saw unprecedented growth to meet rising demand, adding almost 100 new branches throughout the country and doubling the total number of loans disbursed to reach the milestone of 1 million loans served. The company prides itself particularly on providing opportunities and a path out of poverty for crucial segments of the Egyptian population. Almost 70% of Tanmeyah clients are in Upper Egypt where national poverty rates are highest. In addition, over 70% of borrowers are between 21 and 40 years old, a segment with particularly high rates of unemployment.

Tanmeyah Growth in 2018 …*

+ 76%

Client Count

+ 72%

Total Loans Disbursed

+ 65%

No. of Branches

+ 67%

Trained Employees

*All portfolio figures show increase Y-o-Y Dec.2017 Dec. 2018

EFG Hermes Leasing

While EFG Hermes Leasing focuses on corporations, the division has extended its activity to work with SMEs, providing them with the same expertise and advisory experience provided to large corporate clients. Traditionally, SMEs do not have access to the kind of credit facilities that allow them to grow their businesses and create new job opportunities. In May 2018, EFG Hermes Leasing launched a dedicated programme to target partnerships that facilitate SME financing solutions and saw the contribution of SMEs in its portfolio grow to 15% compared to the 8% seen in 2017. The programme encompasses several initiatives:

- A collaborative agreement between EFG Hermes Leasing and HSBC Bank Egypt to help SMEs access EGP400 million in leasing and financing services throughout 2019. The core of the collaboration agreement is to provide SMEs with low interest rate funding and access to medium and long-term financing for capital expenditure and the ability to streamline cash flows.

- Additional agreements with the Egyptian Arab Land Bank and Ahli Bank of Kuwait to finance SMEs with subsidized interest rates.

- A specialized agreement with the Saudi Development Fund was signed to finance renewables and health care with a portion of the fund directed to finance SMEs in different governorates.

- Two vendor agreements with solar station suppliers, Karm Solar and Solarize, in a strategic alliance to offer solar stations to agricultural clients through a leasing facility, allowing them to generate savings on the cost of energy.

EFG HERMES LEASING

AT A GLANCE …

Over EGP 500 MM

directed to the SME

sector over 3 years.

88% increase in SME

contribution to the

portfolio in 2018.

Agreements with HSBC,

the Egyptian Arab Land

Bank, Ahli Bank of

Kuwait and the Saudi

Development Fund.

ASA International

In a milestone transaction for EFG Hermes and one that marked the firm’s first investment banking foray into frontier markets following the launch of its frontier strategy in early 2017, EFG Hermes acted as joint bookrunner to international microfinance lender ASA International (ASAI) on its GBP 125 million initial public offering on the London Stock Exchange (LSE). With a 12-country footprint spanning Asia and Africa, ASAI is one of the world’s largest privatesector microfinance institutions.

ASAI maintains a loan book with over 1.9 million clients comprised of low-income, predominantly female entrepreneurs across Asia and Africa. The global microfinance lender has outstanding loans of c. USD 300 million and serves its customers through a c. 1,400 branch network with some 9,000 employees operating in India, Pakistan, Ghana, Nigeria, Philippines, Kenya, Myanmar, Sri Lanka, Uganda, Rwanda, Sierra Leone and Tanzania. The company recorded a pre-tax profit of USD 43.4 million in 2017, up 64% year-on-year.

This transaction comes as part of EFG Hermes’ vision to replicate its MENA success in new markets through finding attractive investments that cater to global clients while also advancing the SDGs.

Education: Empowering Youth

The Egypt Education Fund

In May 2018, EFG Hermes, via its private equity arm,

entered into an exclusive partnership with GEMS

Education, one of the world’s leading providers of

private English-language education for students

from kindergarten to twelfth grade (K-12), to

jointly establish a new USD 300 million platform

focused on Egypt’s K-12 education sector. With 20

million enrolled students and a highly underserved education sector, Egypt offers significant

opportunities for creating value in education.

In May 2018, EFG Hermes, via its private equity arm,

entered into an exclusive partnership with GEMS

Education, one of the world’s leading providers of

private English-language education for students

from kindergarten to twelfth grade (K-12), to

jointly establish a new USD 300 million platform

focused on Egypt’s K-12 education sector. With 20

million enrolled students and a highly underserved education sector, Egypt offers significant

opportunities for creating value in education.

The partnership aims to provide high-quality education choices for Egyptian families by

building Egypt’s largest institutional education service provider underpinned by the expertise

GEMS education has acquired over the past 50 years in the UAE and elsewhere. By upgrading

education facilities and providing safe and

effective learning environments, the partnership

contributes to realizing SDG 4’s target 4. A and to

the Egyptian educational system as a whole.

The education sector in Egypt is in dire need of major

investments, and together with our best-in-class school

operator, GEMS, we expect to make a strong impact

in the industry and deliver attractive returns to our investors

Karim Moussa

Co-Chief Executive Officer

Investment Bank

As a first project, EFG Hermes and GEMS

Education have established a strategic alliance

with Talaat Mostafa Group (TMG) to acquire,

operate and develop K-12 schools in the cities of

Madinaty and Al Rehab. The platform subsequently

completed its first investment in Egypt, acquiring

four national and British schools in Cairo’s suburbs

from TMG in a transaction worth EGP 1 billion (USD 58 million). There are over 20 additional

schools in the investment pipeline.

In December 2018, EFG Hermes announced the successful first close of the Egypt Education

Fund with total commitments of USD 110 million indicating the commitment of investors

to the sector and their faith in the ability of the partnership to address the issues facing the

Egyptian education sector. The Dubai-based fund was oversubscribed with total commitments

of USD 110 million — well above the USD 50– 100 million initially targeted.

Zewail City Scholarships

Tanmeyah Microenterprise services signed a five-year cooperation agreement

with Zewail City for Science and Technology worth EGP 662,500 to fund six

scholarships for Zewail City students in 2018-2019. The agreement comes within

the framework of supporting the university’s mission to advance the development

of scientific research and technology education in Egypt, in addition to supporting

Egyptian students and developing their creative abilities. This initiative underscores

Tanmeyah’s commitment to empowering all segments of society, especially youth

and women, and contributes to realizing SDG target 4.3, which aims to increase

access to affordable and quality technical, vocational and tertiary education,

including university.

Tanmeyah Microenterprise services signed a five-year cooperation agreement

with Zewail City for Science and Technology worth EGP 662,500 to fund six

scholarships for Zewail City students in 2018-2019. The agreement comes within

the framework of supporting the university’s mission to advance the development

of scientific research and technology education in Egypt, in addition to supporting

Egyptian students and developing their creative abilities. This initiative underscores

Tanmeyah’s commitment to empowering all segments of society, especially youth

and women, and contributes to realizing SDG target 4.3, which aims to increase

access to affordable and quality technical, vocational and tertiary education,

including university.

Energy: The Vortex Renewable Energy Platform

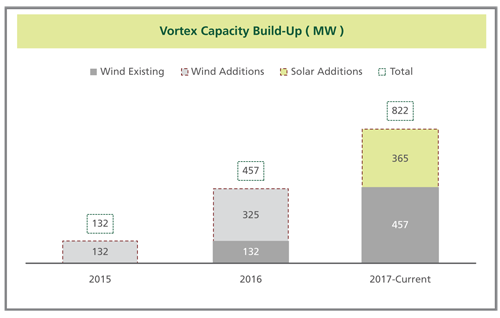

Vortex is a European renewable energy platform managed by the private equity arm of EFG Hermes. In four years, the private equity team has built Vortex from a newcomer in the renewable energy investment field into one of the largest renewable energy-focused investment managers in Europe. Vortex is currently expanding into global markets, with an aim to geographically diversify its clean energy footprint.

Vortex currently manages 822 MW in net capacity of solar PV and onshore wind assets, across the United Kingdom, France, Spain, Belgium and Portugal, well on its way to a target of 1.5 to 2 GW of net installed capacity within the coming years.

With its latest transaction to acquire 100% of a 365 MW operational solar PV power portfolio in the United Kingdom, originally owned by TerraForm Power, Vortex has successfully deployed c. EURO 2.4 billion in the European renewables market since 2014 after acquiring net installed wind capacities of 457 MW through assets managed by EDP Renováveis SA across four Western European jurisdictions. The Solar PV transaction is valued at an Enterprise Value of c. GBP 470 million and comprises 24 operational assets, representing one of the largest portfolios of solar PV in the United Kingdom.

Vortex continues to actively engage in new clean energy investment opportunities

in line with SDG 7’s targets of increasing the global percentage of renewable

energy. Further it has established a specialized asset management arm in the United

Kingdom. The UK-based office provides day-to-day technical and financial services

to Vortex’ solar PV portfolio, aiming to improve performance and create further

value to the platform through potential synergies.

Vortex continues to actively engage in new clean energy investment opportunities

in line with SDG 7’s targets of increasing the global percentage of renewable

energy. Further it has established a specialized asset management arm in the United

Kingdom. The UK-based office provides day-to-day technical and financial services

to Vortex’ solar PV portfolio, aiming to improve performance and create further

value to the platform through potential synergies.

Vortex has already outperformed investment targets in terms of electricity

generation and financial performance demonstrating the attractive financial returns possible

on sustainable and responsible investment.